IT Services : Heading for a massive bull run or a huge recession?

The global IT services sector, particularly Indian IT services companies, has adeptly navigated numerous technological disruptions over the years. From the Y2K wave to the dawn of Web 1.0, the shift to 3-tier architecture, the mobile revolution, and the rise of open-source paradigms, these firms have consistently adapted, transformed, and maintained their dominant position as the foremost providers of cost-effective IT solutions. Today, many of these IT and ITeS (IT-enabled services) players form the backbone of global corporations’ operations, playing a pivotal role in their growth and survival.

However, the AI disruption is unparalleled in its scope and potential impact. Will this be yet another wave that these companies skillfully ride to new heights, or will it mark their Waterloo—a decisive battle that tests their resilience and adaptability?

Why do I pose this question? Let us delve into the convergence of challenges across several dimensions to understand the stakes.

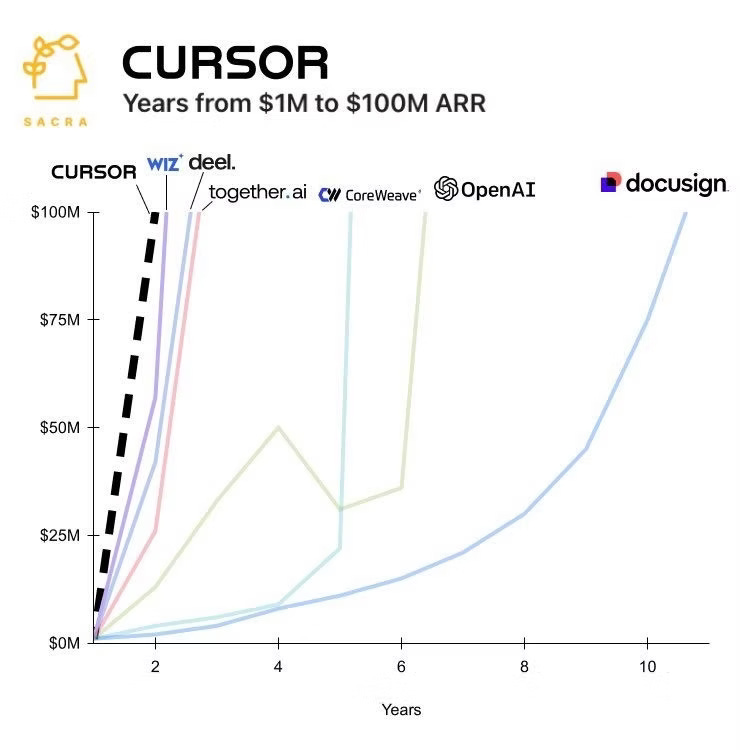

Coding Co-Pilots: Consider the evidence. Generative AI and other AI models, though still in their nascent stages, are already delivering productivity gains exceeding 50%, alongside remarkably high-quality outputs. I anticipate these gains will soon surpass 70%, if they haven’t already—though precise measurements remain elusive. Most developers are currently in a phase of exploration and learning. Within our own organization, teams are extensively leveraging tools like Cursor, achieving a throughput increase of over 50% with ease. In our own organization, our teams are extensively using Cursor and are comfortable with 50%+ higher throughput. The adoption curve, illustrated below, serves as a compelling testament to the transformative impact of these technologies.

Envision a future, perhaps within the next one to two years, where the influence of models transitions from being predominantly predictive to remarkably discrete, unleashing an unprecedented velocity of outputs that will be nothing short of extraordinary.

IT & ITeS Market Saturation: Owing to relentless innovation, aggressive pricing strategies, and unwavering delivery consistency, the majority of Fortune 2000 companies have now integrated at least one or two Offshore/Global service providers into their operations. Over the past decade, the fierce competition for wallet share has driven pricing and contract tenures within the industry to plummet to remarkably low levels, with most deals now spanning three years or less—barring a few substantial agreements that necessitate long-term commitments.

The market paradigm has matured to such an extent that, in recent years, we have witnessed the rise of Global Capability Centers. These entities are essentially organizations establishing their own centers in offshore locations to directly harness the associated benefits.

Consequently, the majority of deals in today’s market are fiercely competitive, characterized by intense wallet share battles among multiple players. In this landscape, pricing has emerged as the pivotal decision-making factor, closely intertwined with competency and a proven track record. The COVID-19 pandemic has further eroded the relationship moats that once fortified large, entrenched players to a significant degree. Having spent a considerable portion of my career as an IT services leader, I recall that even a decade ago, most players—ranging from large to small—would pledge 30%-40% productivity gains as part of their client contracts. These gains were achieved through process improvements, the implementation of various frameworks, and simply extracting more efficiency from their workforce.

In today’s AI-driven world, the question arises: what will clients demand, or what will IT services players offer, to secure deals? Will it be 60%, 70%, or even 80% productivity gains? The stakes have undeniably been raised, and the competition is poised to reach new heights.

The Automation Tsunami:

Back in 2015, I recall spearheading a groundbreaking initiative at my firm, collaborating with a small Singapore-based company specializing in process automation for back-office operations. It took nearly a year of relentless effort to see the automation yield meaningful results. While it didn’t replace our workforce, the potential was undeniable—so much so that Accenture began diving deeper into this domain to unlock productivity gains, some of which were passed on to our clients. Over time, we rolled out large-scale programs with industry leaders like Blueprism, IPsoft and Automation Anywhere, deploying an army of Robotic Process Automations (RPAs) across our global centers. The scale grew so vast that we had to construct an internal control plane to manage these bots, ensuring telemetry and backup systems were in place to handle any downtime.

This shift gave us a significant pricing edge, allowing us to promise clients unprecedented productivity gains in our contracts. However, delivering on those promises often proved challenging post-contract, as legacy architectures and change management hurdles frequently hindered execution. Yet, the firm and its teams always found a way to deliver—or, at the very least, leveraged scope creep to renew contracts at a steady pace.

Fast forward to today, and the landscape has transformed dramatically. A few years ago, venturing into a niche market to develop an application or SaaS platform meant competing with perhaps three or four players at most. Now, no matter how obscure or specialized the niche, you’ll find 40 to 50 startups, flush with capital, racing to automate or reinvent the value chain. Take Stackgen.com, for instance—our startup, which can automate cloud deployments by over 60% and cloud-to-cloud migrations by an impressive 80% (apologies for the plug).

Compounding this shift is the unprecedented amount of capital waiting on the sidelines, poised to be deployed by venture capital and private equity firms into emerging players. What we’re witnessing is nothing short of an automation tsunami—a deluge of AI bots and applications that will intensify pricing pressures, fueled by an explosion of optionality and productivity gains. The question is no longer whether automation will reshape industries, but how swiftly and profoundly it will do so.

Digital Overhang: The pandemic compelled enterprises to accelerate their digital transformation at an unprecedented pace, resulting in a surge of hiring and the creation of countless digital platforms. However, as we near a return to pre-Covid organizational rhythms, it’s evident that the pendulum is swinging back. Amidst the turbulence of financial markets and geopolitical instability, organizations are increasingly prioritizing efficiency over expansion. By any measure, we find ourselves overinvested in the digital dimension of our lives. Consider the plethora of apps on your phone that perform identical functions—this redundancy is mirrored in the B2B enterprise landscape. What the ecosystem now requires is judicious pruning, not further investment. Corporations, if they haven’t already, will inevitably confront this reality.

Adding weight to this perspective, entrepreneurs like Elon Musk have underscored this truth through their actions, particularly with his decisive moves at Twitter and other ventures. Similarly, leaders such as Satya Nadella at Microsoft and Andy Jassy at Amazon are quietly but effectively streamlining their operations. A closer look at their General & Administrative (G&A) budgets reveals a clear shift toward consolidation and optimization. This is not merely an option; it is an imperative for any enterprise aspiring to maintain a leadership position in today’s dynamic landscape.

Employer-Driven Market: This may be the most contentious point I’ll make, and it’s likely to draw criticism. COVID united the world against a common threat, revealing our deepest instincts to protect and defend. For the first time in 80 years, since the world wars, empathy reached its zenith. Employees seized the moment, redefining what an ideal organization should embody—rooted in human connection and compassion, bolstered by unprecedented government support. It was a historically anomalous period.

However, this era also bred complacency, stifling entrepreneurial spirit in favor of catering to individualism in its many forms—be it Wokeism, DEI, or other movements. The pendulum swung sharply to the extreme left, eroding the timeless realities of survival and growth that have governed humanity for millennia. Let me be clear: I am a staunch advocate for DEI when implemented correctly. I have dedicated, and will continue to dedicate, significant time to supporting disadvantaged communities. Yet, I also believe that certain enduring truths—rooted in human nature—will persist. Humans are inherently tribal, and today’s tribes form online, shaped by our choices and preferences. These tribes, whether led by natural or appointed leaders, thrive on hierarchy, innovation, and agility. This dynamic is as true for commercial enterprises as it has always been.

During COVID, organizations (and their leaders) relinquished their assertiveness to prioritize humanity’s immediate needs. That chapter is now closed. Leaders are increasingly reclaiming the age-old structures essential for survival, growth, and leadership. Take Jamie Dimon’s discourse at a recent town hall as an example. Organizations are once again defining the rules of engagement for growth, but this time, it’s a top-down approach, not bottom-up.

As a result, efficiency, cost-cutting, and optimization (often manifesting as layoffs) will become more frequent and pronounced. The pendulum is swinging back.

Scale is the adversary: Over the past three decades, as the industry has expanded, so too have some of its key players in terms of their employee base. To such an extent that size, once considered an asset, has now become a significant liability for myriad reasons. I have long held the conviction that Nature does not favor scale beyond a certain threshold. History is replete with examples spanning the last two centuries where corporations, having grown too large, ultimately succumbed to their own magnitude. From the Mellons and Rockefellers to Westinghouse, GE, Compaq, Sears, Sun, DEC, EDS, and countless others, their eventual downfall was precipitated by the very scale they once celebrated.

Today, the titans of the IT industry—Accenture, TCS, Infosys, Cognizant, Cap Gemini, and DXC—collectively employ over 2 million individuals. Even if these behemoths were to trim a mere 10% of their workforce for performance-related reasons, that would translate to 200,000 employees displaced, particularly in regions like India. Such a move would inevitably destabilize workforce dynamics on a national scale.

Now, consider the ramifications of a more drastic reduction—30% to 50% or more—over the next two to three years. The implications are staggering, and the math speaks for itself.

Synthesis: The IT services market is poised to unfold in either of these two distinct trajectories:

Raging Bull Market: The relentless evolution of technology stacks, coupled with the integration of AI and a pronounced skills shortage, will compel organizations to aggressively recruit AI-centric talent to remain competitive and drive growth. In this scenario, the IT and ITeS sectors will witness an exponential surge in demand for cutting-edge technology stacks, much like they have in previous cycles. Over the next 2-3 years, IT players will inevitably pivot to embrace this new wave of innovation, perpetuating the cyclical nature of the industry.

However, the question remains: will this shift be characterized by the traditional large-scale hiring of fresh college graduates, or will it recalibrate the hiring paradigm to prioritize experienced talent capable of achieving more with less? One could argue that most IT services firms today could deliver comparable outputs with at least 30% fewer employees, provided they are willing to pivot swiftly. But will they seize this opportunity, or remain tethered to conventional practices?

Industry Recession: On the flip side, clients may begin demanding drastic rate cuts of 30% to 50% or more, driven by immediate productivity gains. Procurement teams will revel in leveraging these demands to pit service providers against one another, relentlessly driving down prices to the lowest possible threshold. In an already saturated market, it only takes one player to disrupt the status quo with an aggressive pricing strategy, setting a new, unsustainable benchmark for others to follow. Recall the brokerage fee wars? When Robinhood entered the scene, the cost per trade plummeted to zero—a scenario traditional players had deemed inconceivable, despite years of incremental reductions from $100 to $25, then $10, and finally $5. Yet, it took a single disruptor to dismantle the industry’s economic foundation in a matter of days, wiping out billions in revenue across the board. Could a similar upheaval occur in the IT and ITeS sectors? Perhaps, though the outcome remains uncertain.

A critical caveat lies in the inherent challenges clients face in driving internal change management, which is precisely why outsourcing has flourished as a dominant industry. The very essence of outsourcing, offshoring, or external sourcing stems from clients’ inability or unwillingness to instigate such transformations internally. Yet, in today’s mature and commoditized IT/ITeS market, the question arises: can clients themselves spearhead this change, or will they continue to rely on external partners to catalyze it? If the answer is that clients will persist in their gradual adaptation, then IT service providers may still have sufficient time to cross the Rubicon and navigate this evolving landscape.

But is there sufficient time?

Regardless of the outcome, the reckoning has arrived, and it is staring us in the face. It will be fascinating to observe how the industry and its clients navigate this transformative era. New players will undoubtedly emerge, reshaping the paradigm and triggering large-scale ramifications for providers, clients, and nations alike.

I am bracing myself for this journey, recognizing that showing up has never been more critical. I urge you to do the same—stay vigilant and ensure you’re fully present, not just phoning it in on Zoom.